You’ve just had a child or you’re watching your child grow up—and the specter of college lingers in the back of your mind. How do you start saving for college? What vehicles exist? How much should you save?

The most common college savings vehicle is the 529 plan. These special state-sponsored savings accounts offer tax benefits for parents, grandparents, and other parties interested in saving for a kid’s future. While these plans can be a great solution, they’re not the best solution—especially if you’re savvy.

How much should I be saving for college?

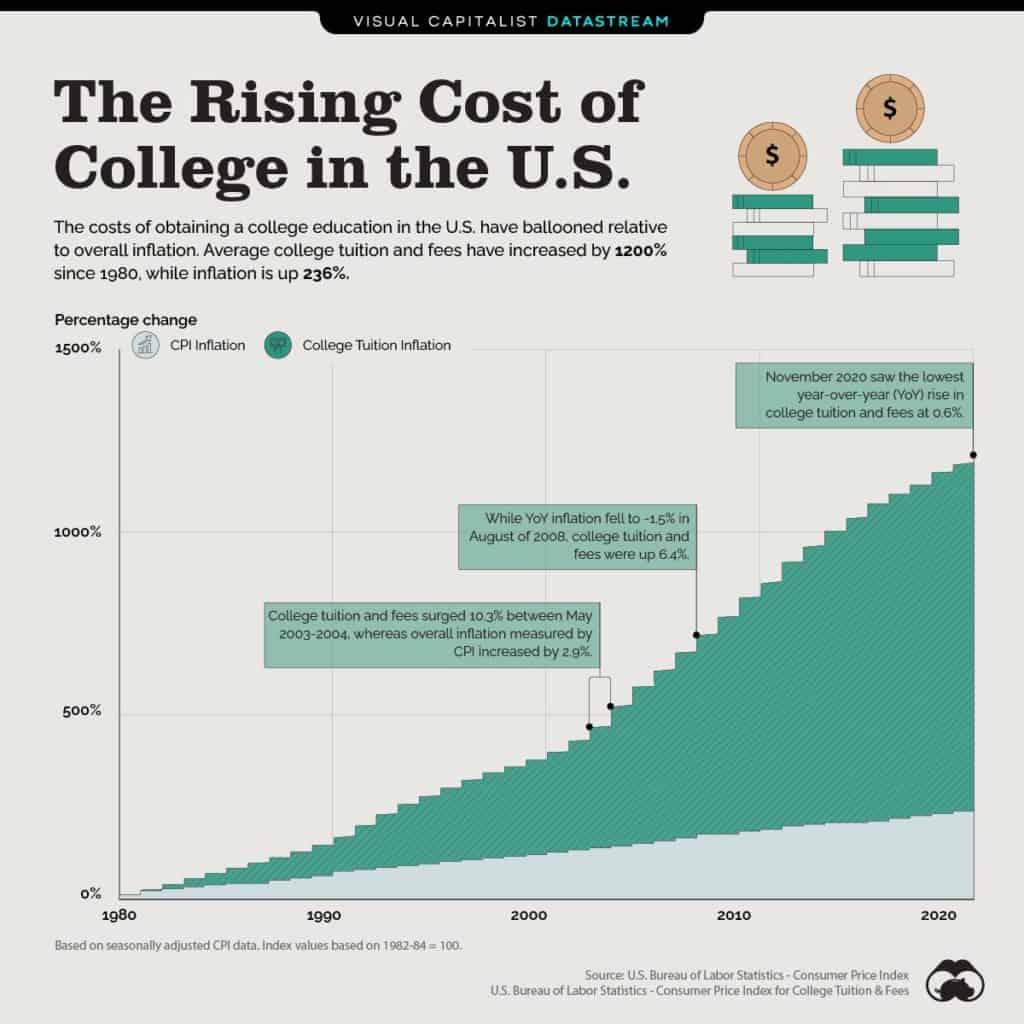

Right now, the stock market may up… but economic worries still linger. Is that really the best avenue for your kid’s savings? Especially because college costs are skyrocketing. The Visual Capitalist charted the increase in college tuition across the U.S.—and found that costs have increased 1,200% since 1980. Inflation has only increased 236%.

But there is some good post-pandemic news: the average four-year tuition and fees for in-state schools only increased by 1.1% between the 2019–2020 and the 2020–2021 school year. Private schools saw a 2.1% increase, according to CNBC.

Related: Teenagers: It’s Never Too Early to Start Investing

Unfortunately, that means you’ve still got a lot to save. Before we dive into alternative college savings methods, let’s determine how much cash you’ll want on-hand. Because let’s face it—college is expensive, and that cost contains a number of moving parts. Ask yourself:

- How many years of college education will you fund? A four-year bachelor’s degree, graduate—or both?

- Will you pay for a private university or only public? Tuition varies dramatically.

- Do you want to fund 100% of the tuition cost? Some parents feel that their children will appreciate and make the most out of their degree when they have to cover a portion of the expenses themselves.

- Are you looking to fund just tuition and books or room and board as well? Some parents don’t want their children to need to work during college. Others feel that working while going to school builds independence and character.

Based on the answers to those questions, you can quantify both the estimated total savings you need.

Let’s say you’re in your late 30s and you’re trying to fund four years of tuition, books, and room and board at the University of Colorado, Boulder, a public, in-state college, for your two-year-old daughter. Using a free online tool like Vanguard College Cost Projector, we can estimate the future cost to be $216,687, assuming a 4% year-over-year cost increase.

Now you can start saving for college.

Option 1: Traditional 529 plans

On the surface, a traditional 529 plan is the easiest, simplest way to start saving for college. While we still believe these plans aren’t best-suited for smart investors, there are some advantages to going with this time-tested option—and a number of disadvantages.

529 plan pros

- Tax-deferred: Plan contributions often qualify for a state-level tax deduction. However, most states have deduction limits, which you’ll need to keep in mind.

- Account earnings: Like other types of savings accounts, your 529 plan monies can be invested in various assets (i.e. stocks/bonds) and grow at a tax-deferred rate.

- Generous maximum contribution and front-load contributions: Most states place a limit on the total maximum contribution limit per 529 plan, but they are very high—typically around $400,000.

- Multiple plans: You can own and contribute to multiple 529 plans. You can even have multiple plans in multiple states, though you may only receive tax breaks for contributions to your home state’s 529 plans.

- Anyone can contribute: While these contributions are considered gifts—so gift tax rules apply—any interested family or friends can contribute to your child’s plan.

- No expiration: 529 plans never expire and you can change the beneficiaries whenever you’d like. If one of your children doesn’t use their funds, the next child can. Saving for college isn’t wasted! Plus, any remaining funds can be saved for future grandchildren.

- No genius penalty: If your child is a genius—and we hope they are—your 529 plan allows you to withdraw an amount equal to the scholarship received by your child without paying a penalty. However, when you withdraw those funds, you may owe taxes on the withdrawal. So the smarter your child is, and the larger the scholarship amount, the more you can withdraw from the 529 plan without penalty.

529 plan cons

- Nominal tax benefits: You do pay tax on the contributions federally. This isn’t tax efficient—federal tax deductions are much more valuable than state tax deductions. We want to maximize our tax efficiency with each dollar, and contributing to a 529 plan doesn’t allow you to do so.

- Funds must be used for qualified education expenses: You can only use the funds in a 529 plan for “qualified education expenses.” Though the list of constituting qualified education expenses is large, it’s still an additional burden.

- You lose flexibility: When you contribute to a 529 plan, you can’t utilize those funds as you wish, thanks to that qualified education expenses rule. Otherwise, you face penalties for withdrawing the funds.

- Who has the education crystal ball? No one knows what higher education will look like in 10 to 15 years when your children go to college. And we have no real idea how much or how little it will cost. Why lock into something that looks good today but may archaic when (and if) your children go to college?

- Your child may not go to college: What if your child decides not to go to college? You’re up the creek without a financial paddle.

Option 2: The earmarked asset strategy

With this strategy, you acquire a property and earmark it specifically for the purpose of funding college tuition. This property is part of your real estate portfolio, but it doesn’t contribute to any other financial goals except funding college tuition.

First, use its positive cash flow and other savings from your disposable income to pay off the mortgage by the time your child starts college. Then, liquidate the property your child’s freshman year. If done correctly, you can fund all four years of college at that time.

Earmarked asset: College savings case study

Let’s walk through the numbers. Your daughter will attend college in 16 years, at which point you will need $216,687 to cover four years of tuition, books, and room and board. (We’ll round down to $215,000 to make the numbers easier.) If we’re going to purchase, pay off, and liquidate an asset to cover those costs, you must net $215,000 after-tax from the sale of the property.

Let’s assume that you will owe 20% to capital gains and depreciation recapture taxes and 7% to sales and closing costs. In order to net $215,000 after-tax, the sales price of the property 16 years from now should be $268,750. If we assume a conservative average property appreciation rate of 2%—less than the rate of inflation—that would mean that we need to acquire a property today for about $200,000.

Related: Leasing a Rental to Your College Kid: Smart Financial Move or Potential Disaster?

Now that you know our target purchase price, you can acquire the property with 25% down and a 30-year, 5% APR mortgage. That makes your initial investment about $50,000.

Next, in order to get this property free and clear in 16 years, you will need to make $365 in extra principal-only payments in addition to your regular mortgage of $805. Let’s assume that the property conservatively produces $165 per month in positive cash flow. That means you would need to contribute $200 per month to get this property free and clear by the time your daughter attends college.

Now let’s look at the 10,000 ft view. When you acquired the property, you invested $50,000 into the deal, and then contributed $200 per month for 16 years—another $38,400. Ultimately, you invested $88,400 to fund $215,000 worth of tuition cost, without exposing yourself to the bipolar whims and sequence of return risk of the stock market.

Option 3: The “cash flow as you go” strategy

If you don’t want to earmark a property specifically for saving for college and you plan to build a substantial real estate portfolio, try this strategy, which involves funding college tuition from your balance sheet. Here, you look at tuition cost as an annual expense funded from your income statement.

For instance, the cost of tuition for Year 1 is $46,124, Year 2 is $48,430, Year 3 is $50,851, and Year 4 is $53,394. You build a portfolio that produces the required income to cover the tuition expense in each of the four college years. The principal difference between this and option two? After you fund college, you still own the assets.

Let’s start with that average cost per year—$49,500. Assuming a free-and-clear 6% yield and a conservative 2% property appreciation rate, we need to acquire a portfolio worth $600,000 now and pay it off in 16 years. By the first year of college, it should be worth approximately $825,000. Again, assuming a 25% down payment on those purchases, we’re looking at around $150,000 in capital required to build this portfolio and deploy this strategy.

This scenario doesn’t just solve college tuition—but your whole financial picture. If we can build a real estate portfolio that can fund $50,000 a year for tuition, we also create $50,000 in passive real estate income toward your retirement income goals.

Option 4: Hire your kids

Behold the better college savings plan for you and your child: hire your kids.

You can deduct payments to folks you employ. And who says those folks can’t be your kids—and they can’t start saving for college super early? When you hire your child in your business, you get to pay them for services rendered and subsequently deduct those payments on the federal and state tax levels.

Again, each dollar we pay our child qualifies for a federal and state tax deduction. That’s already a better start than a 529 plan.

Does your kid have to file a tax return? Not if you pay them less than $12,400! You see, everyone—yes, everyone—gets a standard deduction of $12,400 (as of 2020). If anyone earns less than their standard deduction, they don’t have to file a tax return. So, your child literally receives tax-free money that you received a federal and state tax deduction for.

Let’s put some numbers behind this: You pay little Sam $6,000 for services they provided to your rental portfolio for the year. Your federal tax rate is 33%, and your state tax rate is 8%, so your total tax savings on this $6,000 is $2,460—or $6,000 times 0.41. Your child receives the entire $6,000 tax-free.

OK, so we’ve paid our child. What’s next? We open a Roth IRA in the name of the child. Since you are the fiduciary of the child’s bank account and the Roth IRA, you will direct a $5,500 contribution into their Roth IRA. The cool thing about Roth IRAs: You can always withdraw the contributions tax- and penalty-free. When your child turns 18 and goes to college, they will have a large amount of Roth IRA contributions to pay for their college experience—even if those expenses aren’t “qualified.”

There are also likely to be earnings in the Roth IRA by the time the child goes to college, which can’t be withdrawn without penalties unless they are a qualified distribution. However, a first time home buyer can withdraw $10,000 and not pay taxes or penalties.

Drawbacks and cautions

If this method results in a passive loss, you may lose the tax benefits. But that loss will become suspended, so you will be able to take advantage of the tax savings at some point in the future.

You also need to develop a job description for your child and make the case that you were either going to perform the child’s work tasks yourself or hire another person to do it. (We recommend working with an advisor on this.)

The money that you pay your child must actually hit their bank account and stay in their bank or retirement account. You can’t use that money personally or move it to your bank account. This is called tax evasion, which means fraud.

You also likely can’t pay your one-year-old for rendering services to your rental portfolio… but maybe you can pay your one-year-old for modeling. When the HGTV stars bring their young children on the shows, do you really think their children aren’t being paid for their modeling services? If the HGTV stars have a smart accountant, you can darn well guarantee they are using this method.

Other clever college tuition hacks

Looking for additional brilliant college tuition ideas? Try these suggestions before Junior enrolls.

Related: How You Can Pay for College (And So Much More) with Note Investing

1. Take a deeper look at 529 plans

Yes, we’ve said that 529 plans aren’t the best solution for savvy investors. But maybe you appreciate the simplicity of saving for college with a dedicated account for each child. Here are 529 plan tips and tricks you may not be aware of:

- Multiple accounts in multiple states: You can set up accounts in several states, and you don’t have to combine them, either.

- Contribute without kids: No kids yet? No problem! Because you can add or switch beneficiaries, you can set up an account before you even have children—or the moment you see that plus sign on the pee stick. (Too graphic? Sorry.)

2. Take advantage of the $2,500 tax credit

While we’re talking tax benefits, this is a big one—and can definitely help if you didn’t start saving for college early.

The American Opportunity Tax Credit offers parents up to $2,500 per year—per student!—in tax credits. Remember, tax credits come directly off of your tax bill, as opposed to tax deductions which only come off of your taxable income.

3. Go mortgage-free

Rental properties aren’t the only way real estate can help pay for college. Consider this more conservative approach: “Put extra money towards your mortgage, so that it is completely paid off by the time your children start school,” explains Certified Financial Planner Matt Becker of Mom and Dad Money. “You get a guaranteed return at the interest rate of your mortgage, and paying it off frees up significant cash flow that can be used towards college expenses or any other savings needs you have at the time.”

Instead of writing the check to your mortgage lender every month, you can write it to Junior’s college. That may not have you leaping into a spontaneous celebration dance, but it’s better than choking down the cost of both, right?

4. Research grants and private scholarships

Everyone is familiar with academic and athletic scholarships doled out by colleges. But the bucks don’t stop there.

Grants are generally need-based aid provided by either federal, state, or local governments—or even by the college itself. Read more here about state standards for need-based grants.

Private scholarships are a different animal. Most often, they are offered by private entities, such as foundations, nonprofits, and for-profit companies. These are usually merit-based rather than need-based.

But here’s the thing: There are thousands of them, and they can be quite niched and obscure. So, even if the college doesn’t offer a scholarship to your handstand hopscotch champion, the Hand-Walking Hopscotch Association of America might. These can be fabulous complements to what you’ve been saving for college. However, the trick is finding the right scholarship. Get some help from NextGenVest, which offers free mentoring and help with finding scholarships, and try out Scholly as well.

5. Negotiate with the college

Everything in life is negotiable, right? If your child isn’t offered the keys to the campus with a huge scholarship, challenge the college on it.

Remember, the FAFSA application doesn’t include all of your expenses. Additionally, colleges look at last year’s tax return, which may not reflect your current finances. Sit down with your child to write a formal appeal letter (from your student), making a compelling case that the college should reconsider offering aid.

Reference: https://www.biggerpockets.com/blog/fund-college-tuition-real-estate-investments-2